Family Business Arguments Go Deeper than You Think

I frequently encounter family businesses with generational disagreement about how the company should be run. These disagreements tend to be interpreted as variations on the following themes: The older generation perceives that the younger generation just wants to mix things up or put their stamp on the business, without commensurate experience to support its ideas. The younger generation perceives that the older generation is uncomfortable with technology, afraid of change, set in its ways, and risks falling behind.

These arguments mask a deeper level of disagreement.

As significant as differences of opinion can be about investing in a company and how to fund those investments, the disconnect is usually due to conflicting strategic goals for the business and the selves.

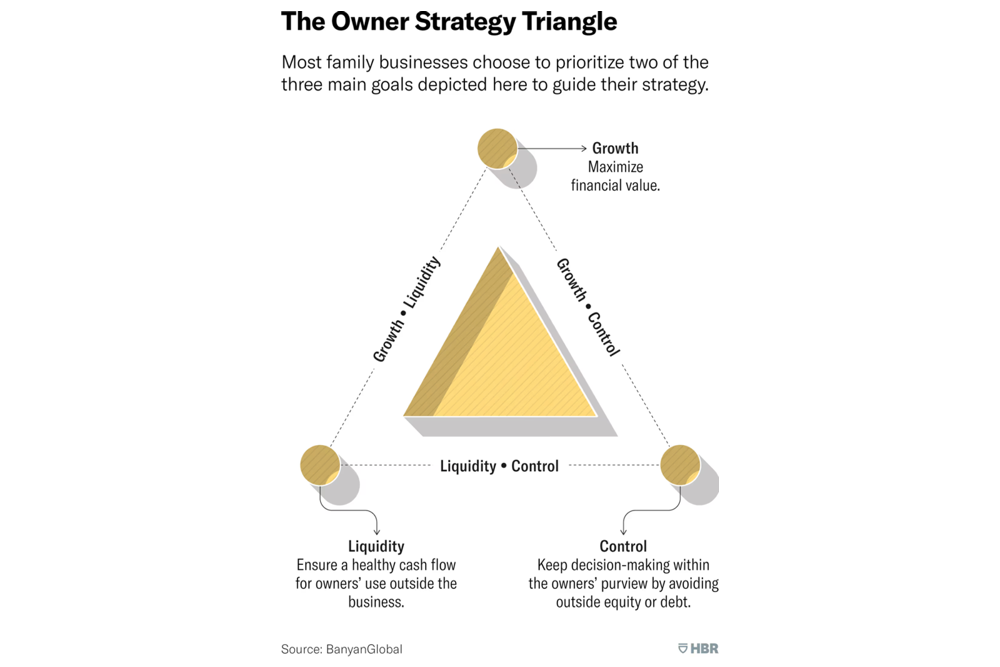

Three broad strategic goals apply to privately held companies: Growth, control, and liquidity. Growth is about maximizing the financial value of the company, control is about keeping decision-making within family ownership, and liquidity is about providing healthy cash flow for the owners’ personal use.

These three goals sit on points of a triangle, which Banyan Global calls the “owner strategy triangle.” Draw a triangle now and put one of these words (growth, control, liquidity) at each point. Many family business conflicts can be traced to this triangle.

Let’s say the younger generation is focused on growth and the older generation is focused on control. In this scenario, taking on an equity partner to make a big investment may suit the younger generation’s growth interest, but is anathema to the older generation’s desire to maintain control.

Happily, most business owners do not sit firmly on one point of the triangle, but tend to prioritize two of the three strategies (the sides of the triangle). If the growth-minded person in our example more accurately represents a growth-plus-liquidity mindset, and the control-minded person in our example more accurately represents a control-plus-liquidity mindset, then the shared interest in liquidity can become an area of agreement and reveal opportunities for mutually-agreeable solutions.

If your family business is arguing about (or in most cases, dancing around) conflicts of this nature, it is very useful to haul out this model and identify where each family member is on the triangle and how that relates to their vision for the company. Getting past the superficial disagreement and into the substance of strategy can lead to transformative conversations.

This article was written by Andrea Hill and originally ran in LinkedIn

Andrea Hill's

Latest Book

Straight Talk

The No-Nonsense Guide to Strategic AI Adoption

Where other books focus on prompts and tools, this book gives business leaders what they actually need: the frameworks and confidence to lead AI adoption responsibly, without having to become technologists themselves.

Also available at independent booksellers and public libraries.

Are You Ready to Do Better Growth Management?

StrategyWerx is all about growth strategy and management. That means giving you the tools you need to develop sound strategies, structure your organization to lay the track ahead of the train, and implement the tools you need to grow. Ready to learn more about how we do that? Book a free consult and bring your questions. See if you like working with us on our dime, and get some good advice in the process.